red lake gold inc. positions for strong copper market with the soo north copper project; adjacent sterling metals corp.’s soo copper project

Vancouver, British Columbia, October 7, 2025 - Red Lake Gold Inc. (CSE: RGLD)(“Red Lake Gold” or the "Corporation" or the “Issuer”) is pleased to announce that it has acquired an inaugural copper exploration project, the Soo North Copper Project (the “Soo North Copper Project” or “Soo North”) situated in Ontario, Canada.

As reflected in today’s announcement regarding the Soo North Copper Project, the Issuer has interest in conducting copper exploration noting that copper prices sit near record highs, with the London Metal Exchange (LME) copper cash settlement being at approximately US$10,610 per tonne as of October 6, 2025, approaching the record high set in May 2024. The Issuer is of the opinion that copper’s pricing dynamics may help facilitate a continued strong near-term market for the commodity.

Soo North Copper Project - Overview

The Soo North Copper Project is a large copper exploration project situated directionally north of Sault Ste. Marie, Ontario, and, at its formation, the project comprises a total of 416 mining claims covering approximately 9,142 ha (the latter as measured by QGIS).

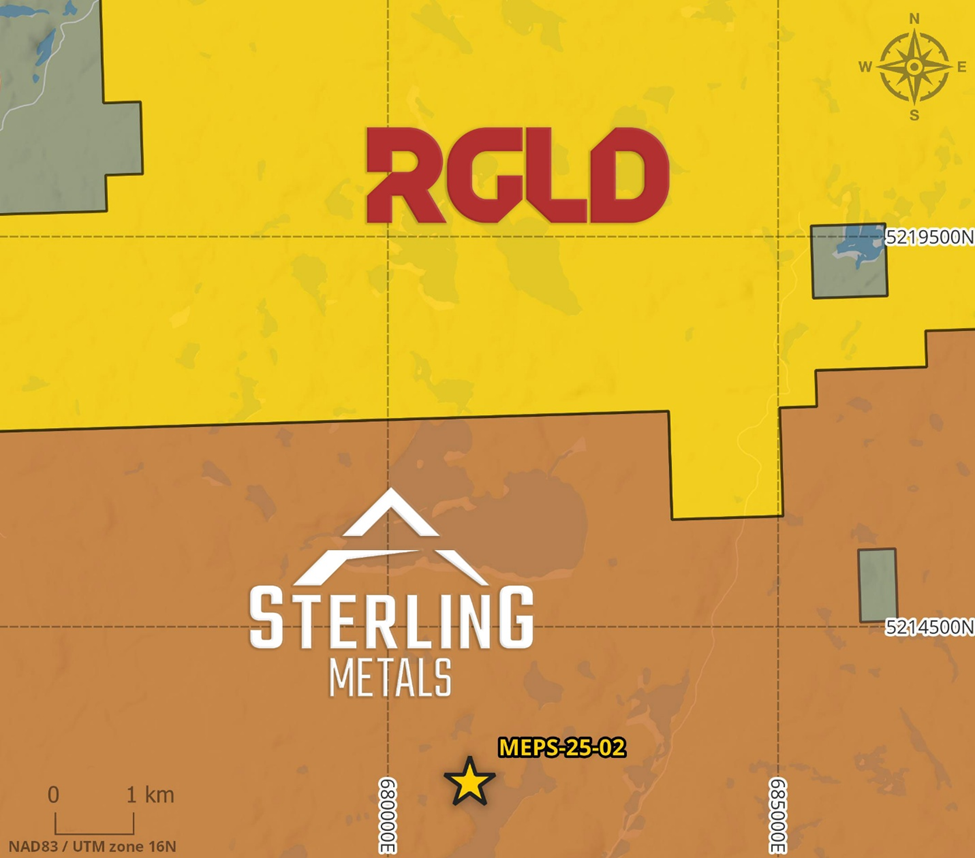

Prompt acquisition of the Soo North Copper Project was guided by a newly announced high-grade copper discovery drill intercept at a (now-adjoining) third-party project. Specifically, the Soo North Copper Project is contiguously located (along a significant east-west claim-boundary) to Sterling Metals Corp. (“Sterling Metals”)(see Figure 1 below), which recently reported drill results (highlighted by drillhole MEPS-25-02) at their adjacent Soo Copper Project (the “Sterling Metals Copper Discovery”)(see news release by Sterling Metals Corp., Sterling Metals Announces High-Grade Copper Discovery at the Soo Copper Project Intersecting 262.5m of 1.05% CuEq, Including 68.3m of 3.25% CuEq and 9.3m of 19.8% CuEq from Near Surface, dated September 29, 2025).

Importantly, the Issuer credits its success in acquiring the Soo North Copper Project to its same-day work around news of the Sterling Metals Copper Discovery, and the Issuer has now subsequently paid the applicable Crown staking fees to the Government of Ontario.

As a result, the Issuer owns a 100% interest in the Soo North Copper Project, without any third-party share or cash property earn-in payments due under an industry-commonplace option agreement. To this, the Issuer’s first-mover advantage presents reduced dilution advantages versus earn-in burdens prospectively faced by other regional entrants that may be now examining the area. Moreover, the Issuer’s new copper exploration project is held on a royalty-free basis (save to the Crown), providing it additional flexibility around project development, as well as shareholder upside.

Figure 1: Soo North Copper Project (Northern Area)

Subject to applicable funding, the Issuer believes that the Soo North Copper Project opens exciting copper exploration opportunities for the Issuer going forward.

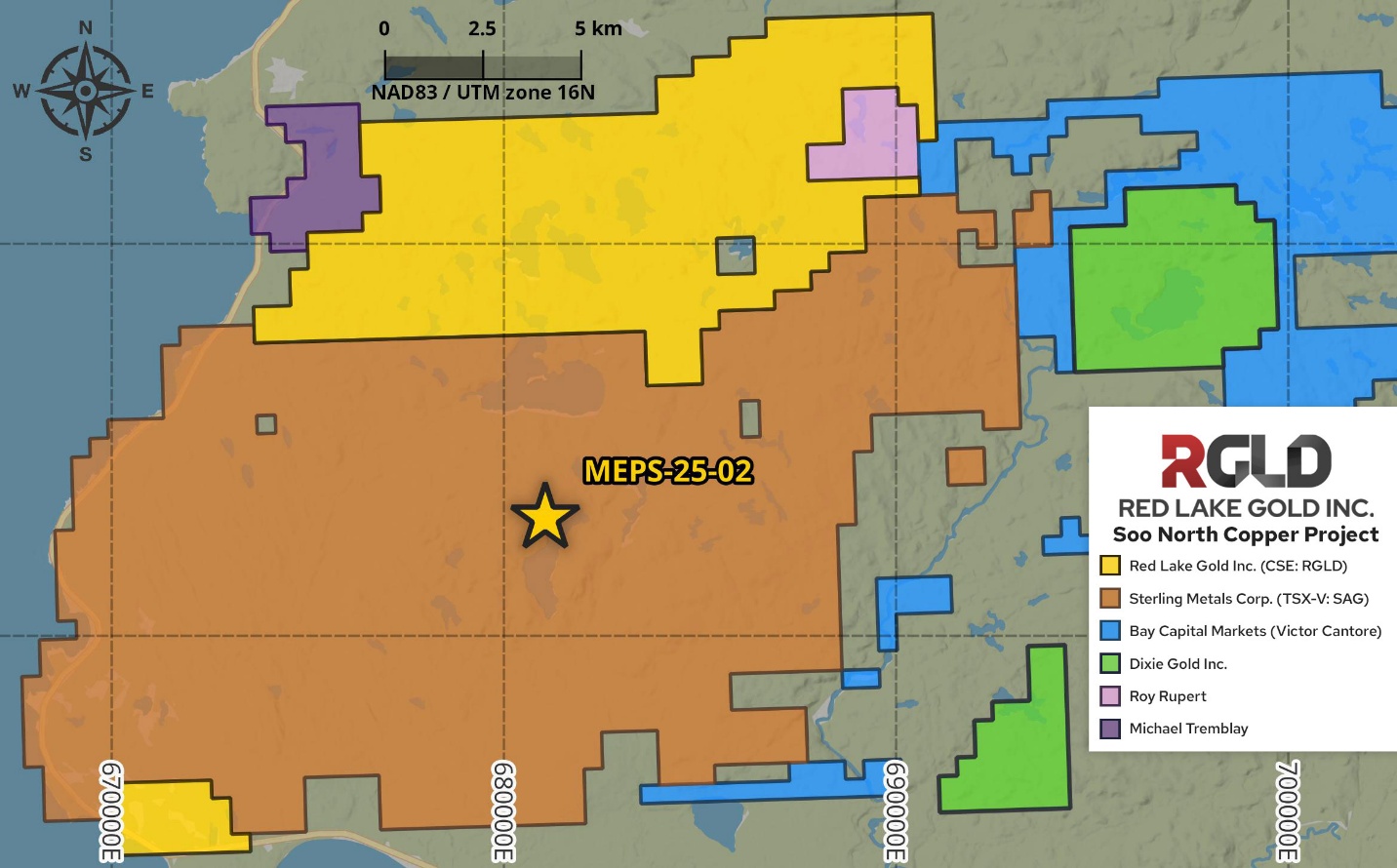

An area map of the currently-constituted Soo North Copper Project, within a selected regional context (as obtained through publicly available MLAS data), is provided by way of Figure 2, below.

Figure 2: Soo North Copper Project (Regional Project Context)

Given the required same-day speed at which the Issuer had to move to cost-effectively secure project area contiguous to the Sterling Metals project that hosts the Sterling Metals Project Discovery, the Issuer has certain near-term review work to complete to determine prioritized next steps. The Issuer expects that the retention of third-party geologic consultants will be required to perform certain tasks, and any field programs, because the Issuer has limited management at the current time, such outside work expected to necessitate funding and subsequent expenditures, prospectively of material scope.

Soo North Copper Project – Preliminary Geological Highlights

Technical information in this news release has been reviewed by a Qualified Person (see Qualified Person section below).

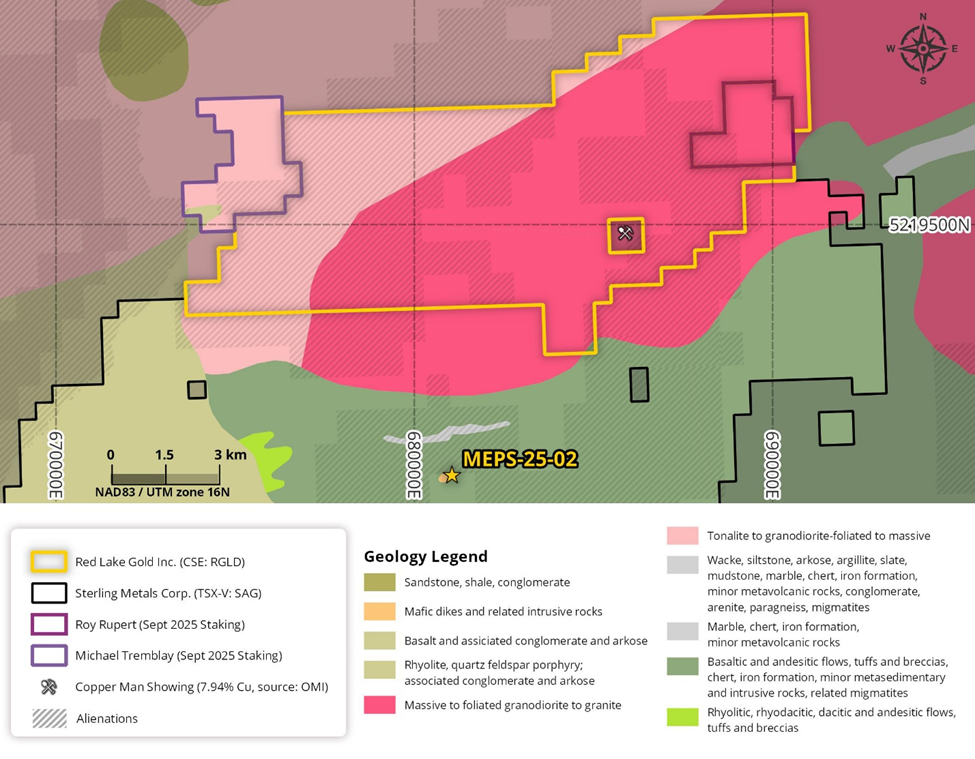

An initial geology map (with data drawn on from government sources, including MLAS) is shown in Figure 3 below.

Figure 3: Regional Geology (MLAS Geolayer)

There are several geological and mining claim aspects that the Issuer notes about its Soo North Copper Project.

First, the Issuer is the largest claim holder over a mapped granodiorite structure, followed by Sterling Metals as the second largest claim holder over that same mapped granodiorite structure. Viewed in the aggregate, the Issuer and Sterling Metals, control the majority of said mapped granodiorite body, to their respective independently owned claim blocks. Granodiorite can host copper mineralization.

Of relevance, historically identified copper mineralization appears to be situated within the mapped granodiorite, as example the Copper Man showing, which has mineral file assay of 7.94% copper (see GeologyOntario Mineral Record #MDI41N02SE00098), and is situated on a third-party owned inlier claim to the Issuer’s Soo North Copper Project, see above in Figure 3. The indicated copper showing within the mapped granodiorite area may indicate copper-related endowment elsewhere within areas of that mapped granodiorite that are controlled by the Issuer, Sterling Metals and/or other third-parties.

Second, the Issuer also believes certain emerging regional porphyry-affiliated aspects to copper mineralization being found - including with respect to those publicly-reported observations made by Sterling Metals regarding their adjacent Soo Copper Project - may have regional relevance to the granodiorite structure which underlies both sides of the claim-boundary between Sterling Metals and the Issuer, including as may relate to the presence of intrusive and/or porphyry bodies not previously mapped or altogether not explored for in the past as relates to the project area. The Issuer notes the presence of Sterling Metals project contributors like Mr. Roy Rupert having recently staked claims adjacent to and beyond the Issuer’s Soo North Copper Project - within the granodiorite - as potentially reflective of an emerging thesis around expansive regional prospectivity (see also next section entitled ‘Discussion of Recent Soo Copper District Claim Activity).

Third, in light of historic regional mapping which was broad in nature, the Issuer believes that inliers, intrusions and geologic-assemblage variations (once ground mapped with tighter spacing) may also be present and provide for different copper hosting assemblages within its claim block, noting the variety of host rocks that copper mineralization can be found in. Potential future ground-mapping and the use of airborne technologies not available in the 1960’s - when this area received a broad wave a regional exploration - may assist in such determinations, i.e. exploration opportunities may not be limited to historic interpretations (as exemplified by the high-grade nature of the recent Sterling Metals drill intercept).

Fourth, the Soo North Copper Project is also mapped as hosting a volcanic-granodiorite contact in the southern limit of the north block, which is of interest to the Issuer, as well as basalt-mapped geology in a smaller standalone southwest claim block comprising part of the aggregate Soo North Copper Project (see claim area in Figure 2 above), the same being likewise of interest to the Issuer. Lastly tonalite-related coverage in the western-portion of the northern block of the Soo North Copper Project (see claim area in Figure 2 above) is also of interest to the Issuer, noting that both basalt and tonalite can host copper mineralization.

As a whole, the Soo North Copper Project covers a variety of mapped geological settings, which may in future receive varying focus levels as both regional developments and Issuer-ownership generate an enhanced understanding of the most prospective sub-areas of the copper project.

Discussion of Recent Soo Copper District Claim Activity

After the Issuer acquired initial coverage area for the project, the Soo North Copper Project was tie-on staked by Roy Rupert, to area inside the referenced granodiorite (and involving claims staked on or about the evening of September 29, 2025). To public disclosure by Sterling Metals, Mr. Rupert has had significant involvement in their Soo Project, and his like activity within the broadly mapped granodiorite (see Figure 3 above) confirms, in the Issuer’s view, regional interest by long-standing area participants in its emerging potential prospectivity. Subsequent to Mr. Rupert’s tie-on, the Issuer then completed further claim expansion of the Soo North Copper Project (aggregate total of which is shown in Figure 2 above, including regionally identified and selected claim holders identified through Ontario’s public mining claim registry (MLAS)). Coverage of the regionally mapped granodiorite area as held by the Issuer, Sterling Metals and Mr. Rupert, among others, can be viewed through the combination of Figures 2 and 3, and through the underlying Ontario MLAS system itself.

The Soo North Copper Project also shares tonalite-to-granodiorite coverage adjacent to claims staked by Michael Tremblay (also on September 29), a well-known Ontario prospector (see Figures 2 and 3 above).

In the Issuer’s view, recent capital market recognition of Sterling Metals and their Soo Copper Project highlights the potential value that may develop for other regional participants in this revitalizing copper exploration camp.

Forward-Guidance

The Soo North Copper Project complements the Issuer’s developing focus in infrastructure-rich Eastern Ontario, where it is has now successfully developed two new exciting exploration plays, which also includes recent announcement as to the Issuer’s Moray East Gold Project (see Issuer news release, Red Lake Gold Inc. Announces the Moray East Gold Project, Situated Adjacent to New Break Resources Ltd. and Alamos Gold Inc., dated October 2, 2025). Red Lake Gold believes its Moray East Gold Project and the Soo North Copper Project position it with high-impact, infrastructure-accessible opportunities. Capital funding, as available, will be allocated to forward-priorities as identified by the Issuer.

The Issuer favourably views the project diversification enabled by its Soo North Copper Project (and recently added Moray East Gold Project).

Corporate Matters

Including to its recent project additions, the Issuer is reviewing how it can obtain necessary capital to fund immediate working capital needs, and advance exploration, as well as how to address, in part or in whole, such corporate items as may have been noted (without limitation) in its news releases of June 27, 2025, and September 5, 2025.

Whirlwind Jack Gold Project - Update

The Issuer also reports that yesterday, on October 6, 2025, it was delivered a 14-page demand/position letter dated October 3, 2025 from the Grassy Narrows First Nation (Asubpeeschoseewagong Anishinabek), and its self-described “ANA Lands Protection Team”, which includes their legal counsel of Cavalluzzo LLP. The Issuer is presently reviewing the content of this latest demand/position letter having only received it yesterday, but the content, upon preliminary appraisal, materially reflects similar demand themes and positions to those correspondences previously reported on to shareholders by way of Issuer news releases dated April 16, 2025 and October 11, 2024, as generally relates to the mining claims associated with the Issuer’s Whirlwind Jack Gold Project.

The Issuer recently provided other information related to the mining claims of the Whirlwind Jack Gold Project, by way of news release dated September 5, 2025. The Issuer previously reported an accounting impairment of the Whirlwind Jack Gold Project, as detailed in its interim financial statements for the period ended February 28, 2025, as available on SEDAR+.

Disclaimer Regarding Other Projects

The Issuer cautions that results and/or discoveries on other regional and/or adjacent projects, including without limitation the project area held by Sterling Metals Corp. (Soo Copper Project) and/or the third-party-held Copper Man showing, are not necessarily indicative of the results that may be achieved on projects and/or project interests that may be held and/or operated by the Issuer, including, without limitation, at its Soo North Copper Project. The same caution is likewise noted with respect to the Issuer’s Moray East Gold Project and/or Whirlwind Jack Gold Project.

Disclaimer Regarding the Soo North Copper Project

The Issuer cautions the Soo North Copper Project may be subject to certain internal project restrictions, such as alienations, surface restrictions and/or surface notices to be filed, Crown obligations, and the like, applicable items of which will be more fully identified in due course, subject to resource availability. The Issuer is required to complete certain prescribed surface notices for certain claims to maintain their continued standing, for which it will require external assistance, including because the Issuer has limited management at the present time.

Disclaimer Regarding Third-Party News Releases

Neither the Issuer nor its Qualified Person (below identified) is responsible for the content, technical or otherwise, of any third-party news releases referenced in this news release.

Qualified Person

Antonio Carteri, P.Geo., and a "Qualified Person" as defined by NI 43-101, has reviewed and approved the technical information contained in this news release. Mr. Carteri is an independent consultant to the Issuer.

On Behalf of the Board of Directors

Nicholas Koo

Chief Financial Officer

T: 604.687.2038

Email: info@redlakegold.ca

Forward-Looking Statements

This news release contains forward-looking statements. Forward-looking statements address future events and conditions and therefore involve inherent risks and uncertainties, including those risks and uncertainties related to future exploration plans and/or future project standing/composition of the Soo North Copper Project, as well as the ability of the Issuer to satisfy, without limitation, any outstanding and/or forthcoming obligations therewith associated, including, without limitation, any requisite surface right notices and/or consultation obligations and/or assessment work necessary to keep the Soo North Copper Project, and/or parts thereof, in good-standing whether on a near-term and/or long-term basis, as well as the Issuer’s ability to successfully secure necessary market funding, which may involve project disposition and/or material project or equity dilution, and to source name executive officer vacancies, including, without limitation, to those matters identified or referenced in the Disclaimer Regarding Corporate Matters section of this news release, as well as to matters related to the Grassy Narrows First Nation (Asubpeeschoseewagong Anishinabek). Actual results may differ materially from those currently expected or forecast in such statements.

Neither the CSE nor its Regulation Services Provider (as that term is defined in the policies of the CSE Exchange) accepts responsibility for the adequacy or accuracy of this release.

Back To Archive